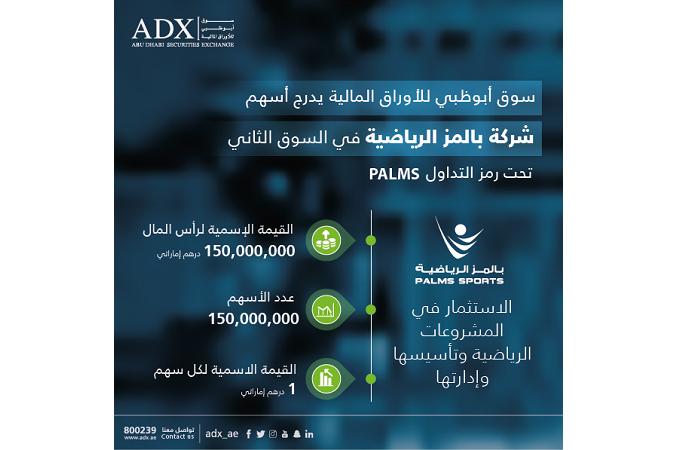

Abu Dhabi Securities Exchange (ADX) Announces Listing Palms Sports on its Second Market

Abu Dhabi Securities Exchange (ADX) announced that Palms Sports P.J.S.C has listed its shares on ADX’s Second Market under the trading symbol PALMS, and trading begins on the shares today. The company’s nominal value of share capital is AED 150 million, with each share having a nominal value of AED 1. This is the fifth listing on ADX in 2020.

Palms Sports, a subsidiary of the International Holding Company (IHC), is a UAE-based company that promotes sporting activities to UAE Nationals and the community in general. Palms Sports is the leading provider for sports training programmes in the UAE, and attains a competitive advantage with regards to Jiu-Jitsu, mixed martial arts, and combat sports. Palm Sports had assets of AED 344.5 million as at the end of September 2020 and over 700 employees.

On this occasion, Mr. Saeed Hamad Al Dhaheri, Chief Executive of ADX, said: “We are delighted that the International Holding Company, one of the largest companies in the region, has listed one of its subsidiaries on our Second Market. This is further validation of the stability of the exchange. This step confirms ADX’s position as a preferred destination that reflects the levels of global competitiveness it provides to the listed companies. Additionally, the exchange provides a highly advanced infrastructure for listing and trading in various securities while adhering to best international practices in the field of disclosure and transparency.”

Fouad Fahmi Darwish, CEO of Palms Sports, said: “Our company was founded to fulfill the UAE vision to inspire and promote a healthy lifestyle through diverse, quality recreational opportunities, and this listing reinforces all the efforts that have been invested to reach the success we have achieved to date. Since our inauguration in 2010, we have experienced rapid growth in becoming the world’s largest Jiu-Jitsu company. This move is in line with our aspirations for sustainable growth and achieving long-term stakeholder value while contributing towards the progress of the Emirate.”

With the listing of Palms Sports, there are now seven companies listed on the Second Market, and 88 securities listed on the Abu Dhabi Securities Exchange. The ADX Second Market is a key component of the exchange’s infrastructure that enables private companies to list. Investors are able to buy and sell securities of private companies depending on fundamentals such as supply, demand, financial information and other disclosures. ADX is the first exchange in the region to have a dedicated platform for the trading of shares of Private Joint Stock Companies.

Trading on the ADX Second Market commenced on 25 November 2014 to support sustainable economic growth across all sectors. The market capitalization of companies listed on the Second Market amounted to around AED 11 billion on 17 December 2020. From the beginning of the year through 17 December 2020, the Second Market has witnessed trading turnover of almost 19 times with 1.2 billion shares traded.

About Abu Dhabi Securities Exchange:

Abu Dhabi Securities Exchange (ADX) was established on November 15 of the year 2000 by Local Law No. (3) Of 2000, the provisions of which vest the market with a legal entity of autonomous status, independent finance and management. The Law also provides ADX with the necessary supervisory and executive powers to exercise its functions. On 17th March 2020, ADX was converted from a “Public Entity” to a “Public Joint Stock Company PJSC” pursuant to law No. (8) of 2020. ADX is part of ADQ, one of the region’s largest holding companies with a broad portfolio of major enterprises spanning key sectors of Abu Dhabi’s diversified economy.

ADX is a market for trading securities; including shares issued by public joint stock companies, bonds issued by governments or corporations, exchange traded funds, and any other financial instruments approved by the UAE Securities and Commodities Authority (SCA). ADX is the second largest market in the Arab region and its strategy of providing stable financial performance with diversified sources of incomes is aligned with the guiding principles of the UAE “Towards the next 50” agenda. The national plan charts out the UAE’s strategic development scheme which aims to build a sustainable, diversified and high-value added economy that positively contributes to transition to a new global sustainable development paradigm.

International Holding Company

IHC was founded in 1998, as part of an initiative to diversify and grow non-oil business sectors in the UAE. Adhering to ‘Abu Dhabi’s Vision 2030’, the ADX listed company endeavours to implement sustainability, innovation, and economic diversification initiatives across what is now one of the region’s largest conglomerates.

IHC has a clear objective of enhancing its portfolio through acquisitions, strategic investments, and business combinations. Comprising more than 30 entities, IHC seeks to expand and diversify its holdings across a growing number of sectors, including Real Estate, Agriculture, Healthcare, Food and Beverage, Utilities, Industries, IT and Communications, Retail and Leisure, and Capital.

With a core strategy to enhance shareholder value and achieve growth, IHC drives operational synergies and maximizes cost efficiencies across all verticals – it also continues to evaluate investment opportunities through direct ownership and entering partnerships in the UAE and abroad. As the world changes, and new opportunities arise, IHC remains focused on resilience, innovation and redefining the marketplace for itself, its clients and its partners.