Bank lending to Saudi private sector records healthy growth

Bank lending to the Saudi private sector recorded a healthy growth in February, according to economic researchers.

Economic data was strong for February, reflecting the impact of the royal decrees issued in January, stated the Saudi Chartbook of April 2015, released by Jadwa Investment.

Cash withdrawals from ATMs recorded a significant monthly increase in response to the two months’ salary bonus, said the report.

The withdrawals grew by 43.4 percent year-on-year, its fastest since April 2011, when a similar bonus was also announced.

PMI points to a healthy expansion in the nonoil sector, according to the Jadwa report. PMI rose to 58.5 in February, reflecting a strong start to non-oil private sector activity in 2015.

Cement production and sales enjoyed a strong start to 2015, with February production and sales up by 14.1 percent and 12.2 percent year-on-year respectively, despite a seasonal monthly slowdown.

In February, government deposits and reserves fell by $8 billion (SR30 billion) and $27

billion (SR100 billion) respectively, indicating that the government remains committed to maintaining a high level of spending. The elevated spending was partially financed by a drawdown from foreign reserves, which fell by $20 billion in February.

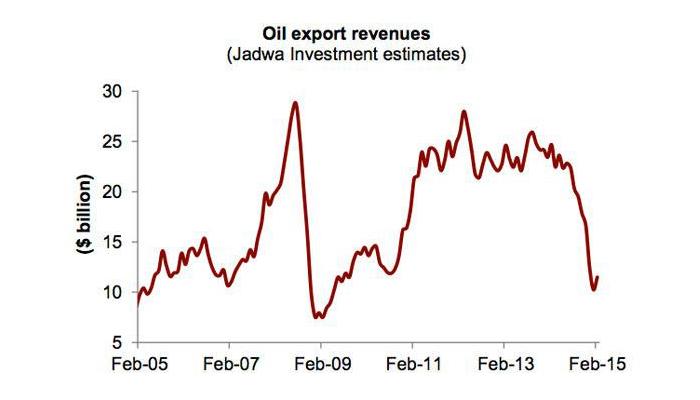

According to the chart book, foreign reserves were probably used to finance additional government spending during the period. Oil revenues — estimated at $11.5 billion in February — were not sufficient enough to mitigate the impact of higher spending on foreign reserves.

Money supply grew at its fastest monthly rate in 26 months as the elevated level of government spending was felt through the domestic economy. Deposits increased significantly as a result of the two-month salary bonus, while currency outside banks also grew at its fastest rate since August, 2011.

M3 grew by 4 percent, month-on-month, its fastest in two years, reflecting the elevated level of government spending in the domestic economy.

Deposits also increased significantly in February, with demand deposits growing by 5.6 percent, also the highest month-on- month growth in two years, boosted by the salary bonus.

The high level of liquidity was also reflected in currency outside banks, growing by 7.8 percent, month-on-month in February, the highest monthly growth since August, 2011.

Bank lending to the private sector recorded healthy growth in February, growing by 0.8 percent month-on-month, and 11.4 percent year-on-year but the high growth in deposits caused the loan-to -deposit ratio to fall back to its December 2014 level, at 79.4.

Bank holdings of SAMA bills fell for the third consecutive month in February.

“Nonetheless, we expect bank holdings of SAMA bills to rise in coming months to absorb the excess liquidity in the economy,” the Jadwa researchers said their report.

The report said that SAMA introduced changes to consumer lending data, both current and historical, to correct for data on real estate lending, financial leasing, and margin lending. As a result, total consumer loans are now lower for each of the nine years (2005-2013), with the gap widening to its greatest extent in 2013.

Under the new classification, real estate lending, financial leasing, and margin lending have been excluded from consumer loans. The new data now excludes real estate financing from the renovation and home improvement category, causing the new total value of renovation and home improvement loans to fall significantly in recent years.

The exclusion of financial leasing also means that the cars and automobile loans category is now lower. The difference between old and new data in this category widened in recent years to reach SR27 billion in 2013.

CPI slowed for the sixth consecutive month, reaching 2.1 percent year-on-yea in February, the chartbook added.

Both the core index and foodstuffs continued to slow while housing inflation rose. Foodstuffs continued to slow as international food prices continued their deflationary trend, according to the report.

The acceleration in housing inflation was mainly pushed by a rise in rentals for housing. Foodstuffs slowed to 1.7 percent, year-on-year, as international food prices continued their deflationary trend while housing inflation rose, pushed by rental inflation, which accelerated to 4 percent, year-on-year.

The value of nonoil exports continued to decline in January, reflecting the impact of lower prices, since volumes exported recorded a monthly increase from 3.7 million tons in December to 3.9 million tons in January.

The value of imports have also recorded a decline in both monthly and year-on-year terms. January imports declined by 9.4 percent month-on-month and 9.1 percent year-on-year.

While imports recorded a decline, new LOCs opened point to a stable level of imports in coming months.

The report said that global oil prices remained depressed in March. Oil prices were down marginally, month-on-month, in March as ample global supply continued to weigh down both WTI and Brent. Brent averaged $56 per barrel in March compared to $58 per barrel a month earlier. US oil production continued to outweigh domestic demand leading to continued growth in commercial crude stocks.

According to the report, Saudi Arabia’s output is likely to increase in the near future as the Yasref refinery is fully online. Bad weather again hampered exports and Iraqi production in February whilst Libyan supply was affected by internal conflict.

Latest data for January shows that colder weather and a drop in Iraqi exports led to Saudi exports rising to 7.5m bpd.

Tadawul All Share Index (TASI) was down in March as a combination of persistently low oil prices, instability in Yemen and the possibility of sanctions being lifted from Iran had a negative impact on sentiment among investors, said the chartbook.

The TASI recorded its first drop after two consecutive months of positive performance.

“Although the TASI dropped in March we expect a recovery in April as the opening up of the Tadawul is announced,” said the researchers.

Performance in the month down by 4.6 percent but this was the same story across regional markets too, according to the chart book.

Average daily turnover declined by 4.8 percent in March, reflecting more subdued investor activity related to lower oil prices and uncertainty in regional geopolitical events. Real estate, banks and petchem sectors dominated daily turnover.

Economic data was strong for February, reflecting the impact of the royal decrees issued in January, stated the Saudi Chartbook of April 2015, released by Jadwa Investment.

Cash withdrawals from ATMs recorded a significant monthly increase in response to the two months’ salary bonus, said the report.

The withdrawals grew by 43.4 percent year-on-year, its fastest since April 2011, when a similar bonus was also announced.

PMI points to a healthy expansion in the nonoil sector, according to the Jadwa report. PMI rose to 58.5 in February, reflecting a strong start to non-oil private sector activity in 2015.

Cement production and sales enjoyed a strong start to 2015, with February production and sales up by 14.1 percent and 12.2 percent year-on-year respectively, despite a seasonal monthly slowdown.

In February, government deposits and reserves fell by $8 billion (SR30 billion) and $27

billion (SR100 billion) respectively, indicating that the government remains committed to maintaining a high level of spending. The elevated spending was partially financed by a drawdown from foreign reserves, which fell by $20 billion in February.

According to the chart book, foreign reserves were probably used to finance additional government spending during the period. Oil revenues — estimated at $11.5 billion in February — were not sufficient enough to mitigate the impact of higher spending on foreign reserves.

Money supply grew at its fastest monthly rate in 26 months as the elevated level of government spending was felt through the domestic economy. Deposits increased significantly as a result of the two-month salary bonus, while currency outside banks also grew at its fastest rate since August, 2011.

M3 grew by 4 percent, month-on-month, its fastest in two years, reflecting the elevated level of government spending in the domestic economy.

Deposits also increased significantly in February, with demand deposits growing by 5.6 percent, also the highest month-on- month growth in two years, boosted by the salary bonus.

The high level of liquidity was also reflected in currency outside banks, growing by 7.8 percent, month-on-month in February, the highest monthly growth since August, 2011.

Bank lending to the private sector recorded healthy growth in February, growing by 0.8 percent month-on-month, and 11.4 percent year-on-year but the high growth in deposits caused the loan-to -deposit ratio to fall back to its December 2014 level, at 79.4.

Bank holdings of SAMA bills fell for the third consecutive month in February.

“Nonetheless, we expect bank holdings of SAMA bills to rise in coming months to absorb the excess liquidity in the economy,” the Jadwa researchers said their report.

The report said that SAMA introduced changes to consumer lending data, both current and historical, to correct for data on real estate lending, financial leasing, and margin lending. As a result, total consumer loans are now lower for each of the nine years (2005-2013), with the gap widening to its greatest extent in 2013.

Under the new classification, real estate lending, financial leasing, and margin lending have been excluded from consumer loans. The new data now excludes real estate financing from the renovation and home improvement category, causing the new total value of renovation and home improvement loans to fall significantly in recent years.

The exclusion of financial leasing also means that the cars and automobile loans category is now lower. The difference between old and new data in this category widened in recent years to reach SR27 billion in 2013.

CPI slowed for the sixth consecutive month, reaching 2.1 percent year-on-yea in February, the chartbook added.

Both the core index and foodstuffs continued to slow while housing inflation rose. Foodstuffs continued to slow as international food prices continued their deflationary trend, according to the report.

The acceleration in housing inflation was mainly pushed by a rise in rentals for housing. Foodstuffs slowed to 1.7 percent, year-on-year, as international food prices continued their deflationary trend while housing inflation rose, pushed by rental inflation, which accelerated to 4 percent, year-on-year.

The value of nonoil exports continued to decline in January, reflecting the impact of lower prices, since volumes exported recorded a monthly increase from 3.7 million tons in December to 3.9 million tons in January.

The value of imports have also recorded a decline in both monthly and year-on-year terms. January imports declined by 9.4 percent month-on-month and 9.1 percent year-on-year.

While imports recorded a decline, new LOCs opened point to a stable level of imports in coming months.

The report said that global oil prices remained depressed in March. Oil prices were down marginally, month-on-month, in March as ample global supply continued to weigh down both WTI and Brent. Brent averaged $56 per barrel in March compared to $58 per barrel a month earlier. US oil production continued to outweigh domestic demand leading to continued growth in commercial crude stocks.

According to the report, Saudi Arabia’s output is likely to increase in the near future as the Yasref refinery is fully online. Bad weather again hampered exports and Iraqi production in February whilst Libyan supply was affected by internal conflict.

Latest data for January shows that colder weather and a drop in Iraqi exports led to Saudi exports rising to 7.5m bpd.

Tadawul All Share Index (TASI) was down in March as a combination of persistently low oil prices, instability in Yemen and the possibility of sanctions being lifted from Iran had a negative impact on sentiment among investors, said the chartbook.

The TASI recorded its first drop after two consecutive months of positive performance.

“Although the TASI dropped in March we expect a recovery in April as the opening up of the Tadawul is announced,” said the researchers.

Performance in the month down by 4.6 percent but this was the same story across regional markets too, according to the chart book.

Average daily turnover declined by 4.8 percent in March, reflecting more subdued investor activity related to lower oil prices and uncertainty in regional geopolitical events. Real estate, banks and petchem sectors dominated daily turnover.

Share:

ADD TO EYE OF Riyadh

MOST POPULAR

Saudi Arabia, Indonesia sign MoU for mining cooperation

Friday 18 April, 2025 9:18Dubai Maritime Authority reports outstanding performance in 2024

Thursday 17 April, 2025 8:52DP World’s latest vessel makes maiden call at Jebel Ali Port

Friday 18 April, 2025 9:32ADEX participates in TXF Middle East & Africa 2025 to advance regional export finance collaboration

Thursday 17 April, 2025 8:47Diriyah awards Royal Opera House contract worth SAR 5.1B

Thursday 17 April, 2025 9:05 ×