BECO Capital Expects Consolidation in the Venture Capital Market in the Region

BECO Capital, a regional venture capital firm focused on technology investments in the Gulf Cooperation Council (GCC) countries, today said that the Venture Capital (VC) market has gained momentum in the last 12 months, boosted by successful fundraising by the “Big Four”, a much deeper startup ecosystem across the region, government and private initiatives and increased attention from international VC and strategic investors.

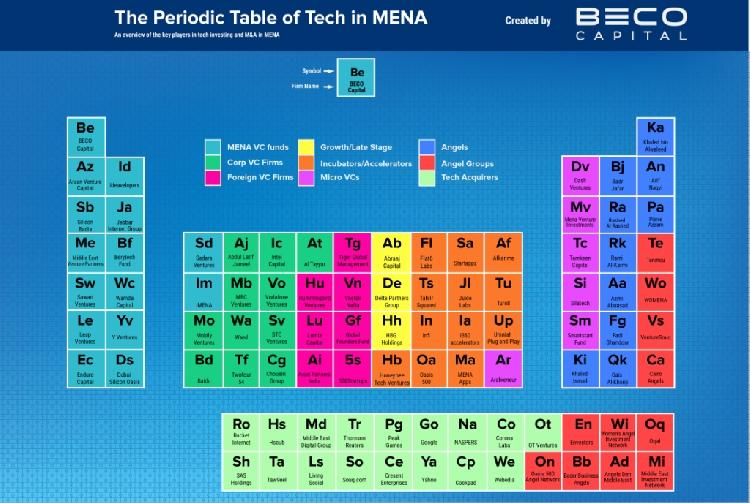

Dany Farha, Chief Executive Officer of BECO Capital, says: “With over 109 players currently investing in the technology startup sector across its various stages, from incubation to angel investments all the way to providing VC growth and late stage capital, the market will trend to consolidation. The industry will shake out the weakest links and reduce the number of players over time. For the rest, they will be riding an ascending trend supported by their sound investments in growing tech companies, their existing dry powder and exits. More money will flow to fewer top performing VC investors and ecosystem builders over time as capital allocation pursues the best performance.”

Nascent, fragmented, but growing market

BECO Capital’s proprietary research shows that of the 109 private players operating in the VC sector in the region, there are 19 regional and seven international VC firms. In addition, there are 10 players in growth/late stage investments. Also, 12 regional conglomerates have set-up VC businesses. Other operators include micro VCs (6), incubators/accelerators (14), Angel Groups (11), Angel investors (14) and Tech Acquirers (16).

Nevertheless, The CEO of BECO Capital asserts that the VC asset class is still vastly underfunded in our region, advocating more allocations from Sovereign Wealth Funds (SWFs), Family Offices (FOs) and institutional investors to the best VC firms. “This will accelerate the creation of our ecosystem, build local tech success stories, ensure that MENA participates in the tech revolution, contribute to a better region and therefore a more stable and prosperous region and, ultimately, provide investors with outsized returns in the process.” For this to happen, the size of the VC firms and funds under management has to grow to enable SWF’s and institutional investors to participate given their minimum investment sizes.

“Even if we add government and private inflows from these players to the sector, the overall contribution of VC in the economy is still minimal, but this is changing”, stresses Dany Farha. Regional VC investments are currently a fraction of those in the US (US$52 billion), China (US$15.5 billion), Europe (US$10.6 billion), India (US$5.2 billion) and Canada (US$1.4 billion). This is against a backdrop of a collective Arab regional GDP of US$2.85 trillion registered last year, with the Arab World ranking among the top ten largest economies; larger than that of India, Russia or Brazil.

Having said this and despite the current market fragmentation, Dany Farha says that he sees the regional ecosystem growing. There will be more VCs being started by government and by private initiatives but, over time, money will mainly flow to major and better performing local VCs with a solid track record”, he explains. “The market is still nascent, but there is a lot of excitement and activity around it. Once it takes off, it will soar. We will be the next big international tech boom story, following in the footsteps of India. When MENA hits its tipping point, it will have its ‘India moment’”.

International VCs have slowly started to converge on the region, having already started investing in some tech companies. However, BECO Capital’s CEO expects them to be coming in droves in five years’ time when the market matures and local VCs have established their track records with unicorns in the making and exits thereof.

Fundraising and deal flow

At the moment, The “Big Four” VC players are scouting the market to deploy the US$ 150 million dry power remaining from their US$ 250 million coffers raised over the last three years. BECO Capital has raised about a quarter of funds committed so far this year, with a mandate to support tech startups in the UAE, Saudi Arabia, Egypt and Lebanon with growth capital, operational improvements and overall value creation.

“VCs offer growth capital. Startups are all about scale and hyper growth, anything else is not a startup. It’s just a new business that might be a great business but isn’t about scale but about dividends,” he says.

BECO Capital, which has acquired stakes in Careem, Propertyfinder and Bayzat, said that not all of the dry powder will go to new investments.

Dany Farha explains: “There are a handful of tech startups that have already proved to be ‘titans-in-the-making’ and an average of 40% of the existing venture money in the reserves of the ‘Big Four’ will be deployed as follow-on growth capital to create value in these portfolio companies ahead of an exit. The rest will be growing the startup pipeline.”

These “titans-in-the-making”, as well as others, have already attracted the attention of international VCs, with major players making a number of investments in tech startups in the region. Others are looking at investing in local VC platforms.

Exits

The sector will reap the benefits of these long-term investments in existing winners in five years’ time.

“The region will witness an impetus of exits greater than a few hundred million dollars each when the VC stars start to exit. I expect one ‘Big Bang’ deal every year starting from 2019, which could include ‘Unicorn’ exits,” Dany Farha says. For him, ‘Big Bang’ deals are those which surpass the US$ 200 million floor and the ‘Unicorns’ are those which will break the US$ 1 billion mark. “The VC ecosystem (Big Four) need to generate at least one US$150 million exit every year starting in 2019 onwards for our deployment to yield VC returns for investors. Such a momentum for exits will bring more money into the ecosystem, creating a healthy positive feedback loop and ensure its sustainability and overall wellbeing”.

He is confident that the exits are coming.

A number of tech startups already achieved offers for 5-12x their Series A valuations in just two years. BECO Capital, as well as other regional VCs, are holding on to their winners, working with their portfolio companies on further value creation.

“For the large established regional tech Titans that have a recognised leadership position in their sector, there is always interest from strategic investors and financial investors. Strategics are already making offers but VCs, us included, are holding off. We want to make sure that we continue to invest and arrange growth capital so we can exit at much higher valuations.” BECO Capital, for one, is already being courted by strategic buyers for its winning portfolio companies.

There is also the option of listing on public markets such as Australia Stock Exchange (ASX) in Sydney, as well as Singapore and Hong Kong. Dany believes that we need to have one major tech Titan IPO that will show investors how large tech companies can become in a relatively short period of time, and the returns they can generate to investors. “This will catalyse investment from all kinds of investors in the technology sector, bringing more tech Titans to the public markets and therefore driving much M&A activity in our region. That’s when the positive cycle will commence”, he says.

BECO Capital’s business model of creating value through post-acquisition initiatives that focus on operational excellence, has been successfully implemented and, as a result, its portfolio companies have continued to thrive and to deliver exponential growth.