Finance Minister endorses SAR 139B borrowing plan for 2025

Minister of Finance Mohammed Al-Jadaan endorsed the annual borrowing plan for the fiscal year 2025, after it was approved by the National Debt Management Center’s (NDMC) board.

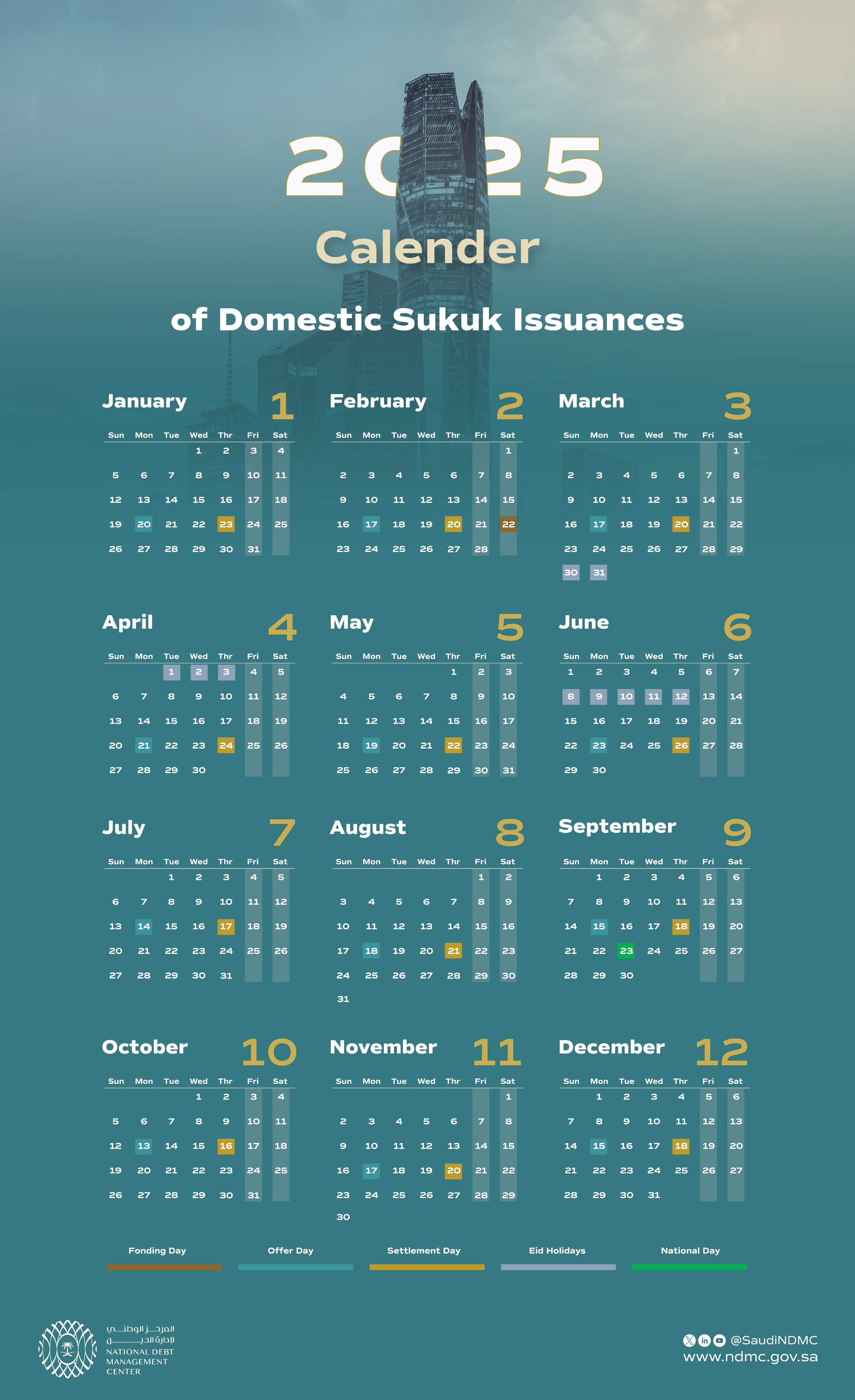

The plan outlines key developments in public debt for 2024, local debt market initiatives, and the financing strategy for 2025, along with its guiding principles. It also includes a review of the 2025 issuance calendar for the Kingdom’s local SAR-denominated sukuk program, according to a statement.

The plan projects that Saudi Arabia will need nearly SAR 139 billion in 2025 to cover an estimated budget deficit of SAR 101 billion and to repay SAR 38 billion in principal debt due that year.

To ensure sustainable access to various debt markets and broaden the investor base, Saudi Arabia plans to further diversify both local and international financing channels in 2025. This will be achieved by issuing sovereign debt instruments at competitive prices, within carefully considered risk management frameworks.

The Kingdom will also capitalize on market opportunities to expand special financing operations aimed at boosting economic growth, such as financing through export credit agencies, supporting infrastructure projects, funding capital expenditures, and exploring new markets and currencies.