GM Reports Strong 2020 Full-Year and Fourth-Quarter Results

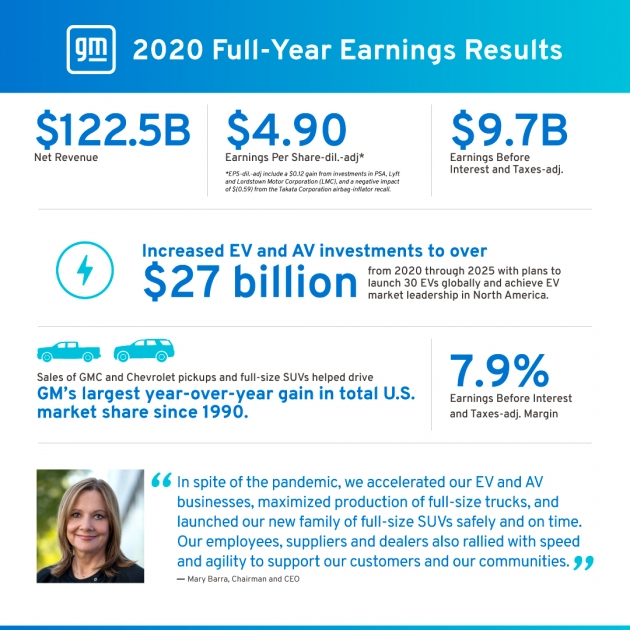

DETROIT, Feb. 10, 2021 /PRNewswire/ -- General Motors Co. (NYSE: GM) today reported strong 2020 full-year and fourth quarter earnings despite production interruptions caused by the COVID-19 pandemic and the impact of the Takata airbag-inflator recall announced in November.

Barra and Chief Financial Officer Paul Jacobson will host a conference call for investors and analysts at 10 a.m. ET today to discuss these results and the company's growth strategy. Introductory remarks will be followed by a question-and-answer session.

Those who wish to listen to the call may dial in using the following numbers:

- United States: 1-888-808-8618

- International: +1-949-484-0645

- Name of call: GM Earnings Call

Full-year 2020 highlights:

- EPS-diluted of $4.33, and EPS-diluted-adjusted of $4.90*

- Full-year income of $6.4 billion, and EBIT-adjusted of $9.7 billion

- Full-year EBIT-adjusted margin of 7.9 percent

- Full-year automotive operating cash flow of $7.5 billion, and adjusted automotive free cash flow of $2.6 billion

- GM North America full-year EBIT-adjusted of $9.1 billion, and EBIT-adjusted margin of 9.4 percent

- GM International full-year EBIT-adjusted of $(0.5) billion

- China Equity Income of $0.5 billion

- Cruise full-year EBIT-adjusted of $(0.9) billion

- GM Financial reported record full-year EBT-adjusted of $2.7 billion

Fourth-quarter 2020 highlights:

- EPS-diluted of $1.93, and EPS-diluted-adjusted of $1.93**

- Fourth-quarter income of $2.8 billion, and EBIT-adjusted of $3.7 billion

- Fourth-quarter EBIT-adjusted margin of 9.9 percent

- Fourth-quarter automotive operating cash flow of $5.2 billion, and adjusted automotive free cash flow of $3.4 billion

- GM North America fourth-quarter EBIT-adjusted of $2.6 billion, and EBIT-adjusted margin of 8.7 percent

- GM International fourth-quarter EBIT-adjusted of $0.3 billion

- China Equity Income of $0.2 billion

- Cruise fourth-quarter EBIT-adjusted of $(0.3) billion

- GM Financial reported record fourth-quarter EBT-adjusted of $1.0 billion

See below for reconciliations of non-GAAP measures to their most directly comparable GAAP measures or visit the GM Investor Relations website for complete details.

*EPS-diluted and EPS-diluted-adjusted include a $0.12 gain from investments in PSA, Lyft and Lordstown Motor Corporation (LMC), and a negative impact of $(0.59) from the Takata Corp. airbag-inflator recall.

**EPS-diluted and EPS-diluted-adjusted include a $0.26 gain from investments in PSA and LMC, and a negative impact of ($0.59) from the Takata Corp. airbag-inflator recall.

General Motors (NYSE:GM) is a global company focused on advancing an all-electric future that is inclusive and accessible to all. At the heart of this strategy is the Ultium battery platform, which powers everything from mass-market to high-performance vehicles. General Motors, its subsidiaries and its joint venture entities sell vehicles under the Chevrolet, Buick, GMC, Cadillac and Wuling brands. More information on the company and its subsidiaries, including OnStar, a global leader in vehicle safety and security services, can be found at GM website

Cautionary Note on Forward-Looking Statements: This press release and related comments by management may include "forward-looking statements" within the meaning of the U.S. federal securities laws. Forward-looking statements are any statements other than statements of historical fact. Forward-looking statements represent our current judgement about possible future events and are often identified by words such as "anticipate," "appears," "approximately," "believe," "continue," "could," "designed," "effect," "estimate," "evaluate," "expect," "forecast," "goal," "initiative," "intend," "may," "objective," "outlook," "plan," "potential," "priorities," "project," "pursue," "seek," "should," "target," "when," "will," "would," or the negative of any of those words or similar expressions. In making these statements, we rely upon assumptions and analysis based on our experience and perception of historical trends, current conditions, and expected future developments, as well as other factors we consider appropriate under the circumstances. We believe these judgements are reasonable, but these statements are not guarantees of any future events or financial results, and our actual results may differ materially due to a variety of factors, many of which are described in our most recent Annual Report on Form 10-K and our other filings with the U.S. Securities and Exchange Commission. We caution readers not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events, or other factors that affect the subject of these statements, except where we are expressly required to do so by law.

Non-GAAP Reconciliations

The following table reconciles profit to net income attributable to stockholders under U.S. GAAP (dollars in millions):

Three Months

Ended Dec. 31, 2020

| Year Ended Dec. 31, 2020 | |

| EBIT-adjusted | 3,712 | 9,710 |

| Adjustments | ||

| GMI restructuring(a) | (26) | (683) |

| Ignition switch recall and related legal matters(b) | 130 | 130 |

| Cadillac dealer strategy(c) | (99) | (99) |

| Total adjustments | 5 | (652) |

| Automotive interest income | 46 | 241 |

| Automotive interest expense | (275) | (1,098) |

| Income tax expense | (642) | (1,774) |

| Net income attributable to stockholders(d) | $ 2,846 | $ 6,427 |

| (a) | These adjustments were excluded because of a strategic decision to rationalize our core operations by exiting or significantly reducing our presence in various international markets to focus resources on opportunities expected to deliver higher returns. The adjustments primarily consist of employee separation charges in the three months ended Dec. 31, 2020 and dealer restructurings, asset impairments, inventory provisions and employee separation charges in Australia, New Zealand, Thailand and India in the year ended Dec. 31, 2020. |

| (b) | This adjustment was excluded because of the unique events associated with the ignition switch recall, which included various investigations, inquiries and complaints from constituents. |

| (c) | This adjustment was excluded because it relates to strategic activities to transition certain Cadillac dealers from the network as part of Cadillac's electric vehicle strategy. |

| (d) | Net of Net loss attributable to noncontrolling interests. |

The following table reconciles diluted earnings (loss) per common share under U.S. GAAP to EPS-diluted-adjusted (dollars in millions, except per share amounts):

| Three Months Ended Dec. 31, 2020 | Year Ended

Dec. 31, 2020

| |||

| Amount | Per Share | Amount | Per Share | |

| Diluted earnings (loss) per common share | $ 2,800 | $ 1.93 | $ 6,247 | $ 4.33 |

| Adjustments(a) | (5) | — | 652 | 0.46 |

| Tax effect on adjustments(b) | 12 | — | (70) | (0.05) |

| Tax adjustments(c) | — | — | 236 | 0.16 |

| EPS-diluted-adjusted | $ 2,807 | $ 1.93 | $ 7,065 | $ 4.90 |

| (a) | Refer to the reconciliation of profit to net income attributable to stockholders under U.S. GAAP for adjustment details. |

| (b) | The tax effect of each adjustment is determined based on the tax laws and valuation allowance status of the jurisdiction to which the adjustment relates. |

| (c) | This adjustment consists of tax expense related to the establishment of a valuation allowance against deferred tax assets in Australia and New Zealand. This adjustment was excluded because significant impacts of valuation allowances are not considered part of our core operations. |

The following table reconciles net automotive cash provided by operating activities under U.S. GAAP to adjusted automotive free cash flow (dollars in millions):

| Three Months Ended Dec. 31, 2020 | Year Ended

Dec. 31, 2020

| |

| Net automotive cash provided by operating activities | $ 5,243 | $ 7,519 |

| Less: Capital expenditures | (1,959) | (5,251) |

| Add: GMI restructuring | 128 | 379 |

| Add: Cadillac dealer strategy | 21 | 21 |

| Less: GM Brazil indirect tax recoveries | — | (58) |

| Adjusted automotive free cash flow | $ 3,433 | $ 2,610 |

SOURCE General Motors Co.