MENA witnessed significant M&A deals in Medical, Insurance, and Education in Q1 2018

Mergermarket, the leading provider of M&A data and intelligence, reports that the M&A first quarter of 2018 has already witnessed deals of significant value in the Insurance, Medical, and Education sectors. The largest deal of the quarter was Total’s investment into the Umm Shaif and Nasr fields and Lower Zakum off-shore concession for a combined US$1.45bn. Key deals were discussed today at Mergermarket’s MENA Mergers 2018 forum hosted at Jumeirah Emirates Towers in Dubai, which serves as a platform for the M&A, Private Equity, and Corporate Restructuring industries.

In line with global trends, pressure from shareholders seeking gaining market share pushed companies towards defensive consolidation through M&A. Domestic deals recorded 13 deals worth $2.5bn, driven by the acquisition of a 53.37% stake in Moroccan insurance firm Saham Finances for $1.05 billion by Sanlam and its general Insurance subsidiary, Santam, the highest quarterly value for the region on since Q1 2017 (US$ 2.6bn).

This trend was also particularly evident in the Medical sector. Two of the top ten deals targeted the Medical sector, both of which were conducted by UAE-based NMC Health Plc. The firm acquired a 49% stake in Fakih IVF Group and a 70% stake in CosmeSurge, for $205 million and $177 million respectively. There were also two significant deals in the Education sector, with Khazanah Nasional Berhad’s $130 million investment into GEMS Education and KMR Holding Pedagogique’s $54 million into the Universite Internationale de Casablanca.

Ruth McKee Al Ghamdi, Head of Mergermarket MENA, commented:

“M&A in the healthcare sector in the region is being driven by increasing demands from populations with high numbers of lifestyle-related illnesses such as diabetes and cardiovascular conditions. Social and economic reforms in Saudi Arabia and technology disruption across all sectors are expected to contribute to the MENA deal making landscape in 2018.”

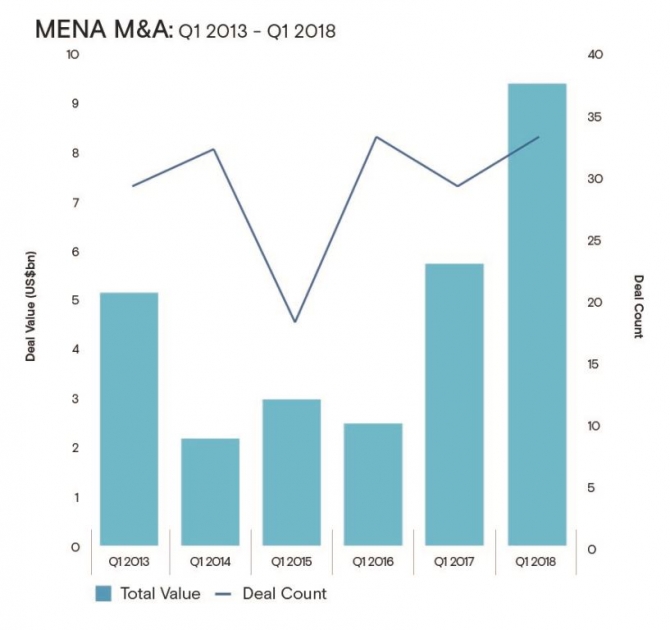

This year, the MENA region has reached its highest Q1 deal value since 2001, as per Mergermarket’s records, with $9.3 billion invested in the region across 33 deals so far.

Omar Momany, Head of the UAE Corporate & Commercial Practice at Baker McKenzie Habib Al Mulla, commented:

“Middle East deal activity over the past few years have been very robust. Deal volumes in both 2016 and 2017 remained consistent despite a drop in deal value in 2017, with the UAE continuing as the most attractive market for inbound investment last year. Baker McKenzie's Global Transactions Forecast with Oxford Economics predicted an uplift in M&A activity in 2018 globally and in the Middle East, and with the apprehension of 2017 easing and the underlying strategic drivers for investment remaining steady, we expect M&A levels in the Middle East to remain healthy throughout 2018 and to peak in 2019.”

Anil Menon, MENA M&A Leader, EY, said:

“We expect a busy summer and an active M&A market in FY18. The primary drivers will be private equity players who are net sellers, sector consolidation plays, and regional family businesses who continue to reconfigure their business portfolios.”

In 2017, the MENA region saw a decline of 57.6% in deal value, despite deal count maintaining a level that was consistent with the previous year. 2017 saw the announcement of a total of 126 deals worth approximately $16.0 billion, compared to 129 deals in 2016 at a total value of $37.8 billion.

The 2018 MENA Mergers forum featured a series of panel discussions, hosted by high level spokespeople from Gulf Capital Abu Dhabi Islamic Bank, NBK Capital Partners (Mezzanine fund) and Abu Dhabi Financial Group, to name a few. The forum was hosted in strategic partnership with Baker McKenzie, EY, Standard Bank, AIG, Instinctif Partners and Intralinks. It will be followed by Mergermarket’s third annual Middle East M&A Awards, which will recognise transaction advisory achievements across a range of sectors including Energy, Mining & Utilities; Financial Services; Consumer; Pharma, Medical & Biotech; Telecoms; Media & Technology; and Industrials & Chemicals.