Saudi Arabia leads IPO market in MENA region during 2020, with four listings totaling US$1.45 billion

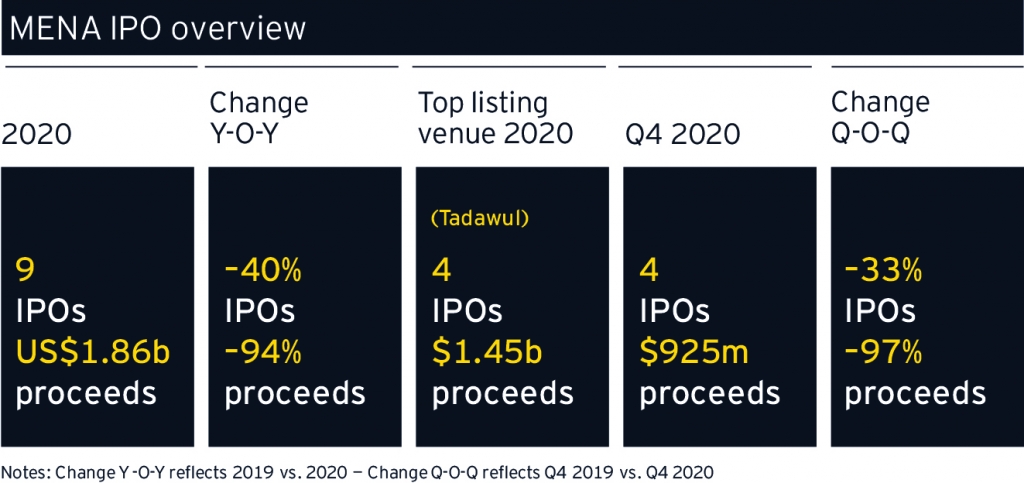

According to the EY MENA IPO Eye Q4 2020 report, the MENA region saw nine IPOs raise proceeds of US$1.86 billion, a fall of 40% in total issuances and 94% in total proceeds when compared with 2019. Out of the nine issuances, six were in the real estate sector, of which two were real estate investment trusts (REITs), with the remaining in the health care, consumer staples and insurance sectors.

Despite a subdued annual picture, Q4 2020 rebounded after a quiet Q2 and one IPO in Q3, with four IPOs in the MENA region raising US$925 million in total. Although the number of IPOs decreased by 33% and proceeds were down 97% compared with the same quarter in 2019, Q4 did have the highest proceeds of 2020.

Globally, IPO numbers continued to pick up with 1,363 IPOs taking place in 2020, a 19% rise when compared with the previous year. Additionally, proceeds increased by 29% from 2019, rising to US$268 billion – the highest proceeds since 2010’s record of US$290.2 billion raised via 1,361 IPOs.

Matthew Benson, EY MENA Strategy and Transactions Leader, says:

“A decline in economic growth and significant disruption across various industries caused by the COVID-19 pandemic, together with a decrease in demand for oil, had a considerable impact on MENA stock performances in 2020. Markets were also impacted at a global level. Market volatility in the first half of the year was higher than at any time since the global financial crisis, although it quickly subsided, and the latter half of the year presented some strong IPO market performances. As 2021 begins, we believe that continued fiscal stimulus measures, an abundance of liquidity and growing confidence in COVID-19 vaccination programs will sustain positive IPO momentum.”

Despite a drop of nearly 30% earlier in 2020, the Tadawul recovered to end 2020 with a positive index return of 3.6%, which was aided by the recovery in crude oil prices. The Egyptian Exchange (EGX) saw the biggest decline among the observed indices, having lost 22.3%. The Abu Dhabi Securities Exchange (ADX) ended the year relatively flat, while the Dubai Financial Market (DFM) and Boursa Kuwait indices both fell by 10% and 13% respectively during the same period. Equity markets in the MENA region experienced high volatility and average daily trading values increased significantly across the main exchanges.

Saudi Arabia continues to lead the IPO market

The Kingdom of Saudi Arabia continued to have the most active IPO market in the MENA region in terms of both issuances and proceeds. Tadawul was MENA’s top listing venue for the year with four listings totaling US$1.45 billion, which represented 78% of the total amount raised by MENA IPO candidates in 2020.

The fourth quarter in 2020 was the strongest quarter for IPOs based on proceeds, primarily due to the listing of BinDawood Holding (US$584 million), which was the second-largest listing of the year after Dr. Sulaiman Al-Habib Medical Services Group Company (US$701 million) listed in Q1 2020. Both listings were on Tadawul’s main market.

Saudi Arabia also saw several new initiatives that have an important bearing on future IPO activity in the country, including the introduction of direct listings on Nomu–Parallel Market, as well as the launch of their derivatives market. Furthermore, in Q4 2020, additional updates related to disclosures becoming mandatory in both English and Arabic, as well as increases in daily price fluctuation limits for new listings on the main market, were announced.

Abdulrahman Moulay Albizioui, Saudi Arabia Strategy and Transactions Leader, says:

“The capital markets in Saudi Arabia have shown their resilience during 2020, both in terms of liquidity and regulations. The outlook for the Kingdom’s markets remains positive for 2021 and as Tadawul continues its growth and status in the international capital markets, it proves to be an important avenue for investors looking to deploy domestic capital and foreign direct investments (FDI).”

The Kingdom is expected to see more than ten listings in 2021. In addition, Tadawul – the region’s largest exchange – is preparing for its own IPO, which is expected to be finalized in 2022. This would make it the third publicly listed stock exchange in the region after the DFM and Boursa Kuwait.

Gregory Hughes, EY MENA IPO and Transaction Diligence Leader, concludes:

“Although MENA IPO activity remained relatively quiet in 2020, several regulators across the region announced positive regulatory changes during the year that bode well for future and existing public companies. As we start 2021, there are reasons for renewed optimism, and we see a strong IPO pipeline in key MENA markets and expect activity to pick up gradually during the new year. We have also seen some interest in mergers with US-listed Special Purpose Acquisition Companies (SPACs) in recent months following some limited activity in this area in the last two years from the region.”