AVIATION EMBARKS ON A DECADE OF GROWTH, BUT EMISSIONS MAY GET IN THE WAY, OLIVER WYMAN REPORTS

Middle East fleet will expand by 4.5% a year over the next decade as demand expected to climb back to pre-pandemic levels in 2023

Report released ahead of MRO Middle East conference in Dubai

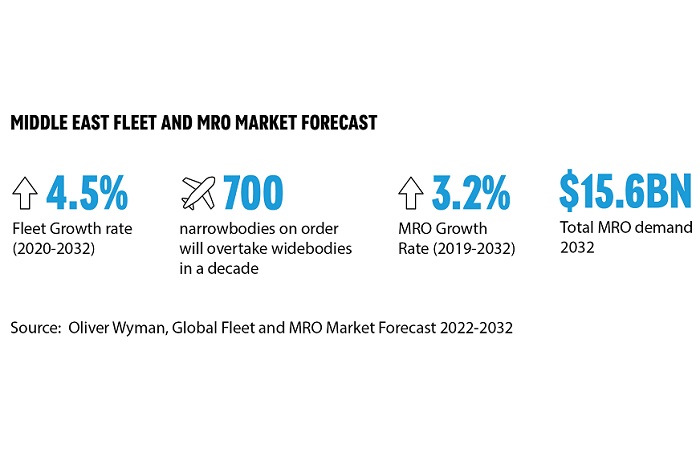

After struggling with COVID-19 for more than two years, the aviation industry is set to rebound — with the fleet growing 4.5% in the Middle East region over the next 10 years , according to Oliver Wyman’s Global Fleet & MRO Forecast 2022-2032. But as pent-up global demand pushes air travel to pre-pandemic levels by 2023, the industry will once again have to confront rising carbon dioxide emissions and its lack of immediate solutions to reduce them.

The widely anticipated report, now in its third decade, digs deep into commercial aircraft deliveries and inventories — as well as aerospace production — to provide a comprehensive view of the size and composition of the commercial fleet over the next decade. The outlook delineates growth both globally and from a regional perspective. Additionally, it analyzes the maintenance, repair, and overhaul services (MRO) that the fleet will require.

Key findings for the 2022-2032 report include:

- Long-term growth for the Middle East is forecast at 4.5% annually, in part because of a strong narrowbody outlook.

- Globally, the fleet growth rate is set to grow to 38,100 aircraft by 2032 — a compound growth rate of 4.1% over the decade.

- Narrowbody aircraft will make up a larger share of the fleet — 64% in January 2032 versus 58% in January 2020 — as the slow recovery of international traffic after COVID-19 is depressing the number of widebodies in service.

- With an influx of narrowbody aircraft expected, the widebody share of the fleet in the Middle East is expected to drop below 50%, and by the end of the decade narrowbodies will overtake widebodies as the largest class.

- In total, the Middle East region has almost 700 narrowbodies on order through the end of the decade spread out among more than 15 operators

- The global fleet won’t reach its pre-pandemic peak of almost 28,000 until the first half of 2023

- The dedicated global cargo fleet grew 3% and conversions of passenger aircraft to freight carriers broke records, thanks to a double-digit expansion in demand with the COVID-19-related explosion in online shopping and the loss of cargo belly capacity.

- The MRO sector is being redefined by a fleet in transition, as airlines begin to take delivery of new, highly fuel efficient narrowbodies and attempt to weed out older aircrafts that will need intensive maintenance sessions.

- By 2030, MRO demand is expected to reach $118 billion, 13% below the pre COVID-19 forecast of $135 billion, showing the lost growth from COVID-19.

“There is optimism that the industry has turned the corner and is now on an upward trajectory -- but the next 10 years will be filled with a multitude of challenges that will test the industry’s resilience unlike ever before,” said Andre Martins, Head of IMEA Transportation & Services, Oliver Wyman.

He added: "Of all the regions, the Middle East is the most dependent on the recovery of international travel to fill its widebodies. Before COVID-19, widebodies made up over 50% of the Middle Eastern fleet versus only 21% of the global fleet. Because of this dependence, the Middle East MRO market is not expected to recover until late 2024.”

No easy climate change solution

Aviation accounted for about 2.3% of total carbon dioxide emissions in 2021 — much less than road transport. But the ability to transition to electric vehicles over the next 10 years is likely to reduce road transport’s share and push aviation’s up — potentially increasing pressure on the industry.

Aviation has no easy fix despite decades of increasing the fuel efficiency of aircraft. While research and development are underway on the use of hydrogen and electric engines as substitutes for conventional fossil fuel-powered aircraft, those revolutionary propulsion systems are at least 15 to 20 years away from commercial production. And the one alternative — sustainable aviation fuel (SAF) — doesn't have enough production capacity or the right economics to work for either airlines or SAF producers.

MRO Middle East

Dubai will host MRO Middle East from 22-23 February, bringing together high-calibre local and international companies who are driving industry innovation and sustainability.

Hosting a panel session at the event will be Robbie Bourke, Partner at Oliver Wyman, who said: “The Middle East is a region where the post-pandemic outlook is optimistic. Once international demand recovers, the Middle East outlook will stabilize with MRO growth of more than 4.8% expected annually, as the young fleet grows at a CAGR of over 4.7% between 2024 and 2032.”

____

- About the Global Fleet & MRO Market Forecast

The 2022-2032 edition of Oliver Wyman’s Global Fleet & MRO Market Forecast Commentary represents our more than two-decade commitment to the understanding and assessment of the commercial airline transport fleet and the associated maintenance, repair, and overhaul (MRO) market outlook. The commentary is the go-to resource of aviation executives—whether a manufacturer, operator, or aftermarket provider, as well as for those with financial interests in the sector through private equity firms and investment banks.

This year’s research focuses on the aviation industry’s recovery from COVID-19, subsequent growth and related trends affecting aftermarket demand, maintenance costs, technology, and labor supply after a devastating 2020. The outlook reveals significant challenges the industry faces as it develops and expands its recovery and rebound plans.

- About Oliver Wyman

Oliver Wyman is a global leader in management consulting. With offices in more than 70 cities across 30 countries, Oliver Wyman combines deep industry knowledge with specialized expertise in strategy, operations, risk management, and organization transformation. The firm has more than 5,000 professionals around the world who work with clients to optimize their business, improve their operations and risk profile, and accelerate their organizational performance to seize the most attractive opportunities. Oliver Wyman is a business of Marsh McLennan [NYSE: MMC].