US$ 2 billion earmarked for Saudi real estate by Muslim global HWNIs.

Muslim global high net worth individuals (HNWI) are prepared to spend US$ 1.96 billion on real estate in the Holy Cities of Makkah and Madinah, according to global property consultancy Knight Frank’s inaugural Destination Saudi report

Knight Frank surveyed 506 Muslim global HNWI from nine countries to understand their attitudes, aspirations and appetite towards real estate investment in the Holy Cities of Makkah and Madinah. Together, the survey respondents own over 2,250 homes around, with 29% already owning between 3-5 properties.

Makkah (30%) has emerged as the top wish list city by Muslim HNWI for real estate purchases in Saudi, while Riyadh (25%) ranks second. Madinah (19%) is the third most popular target location.

Knight Frank's recent findings closely align with the government's January unveiling of new Premium Residency options, including a property-ownership linked visa.

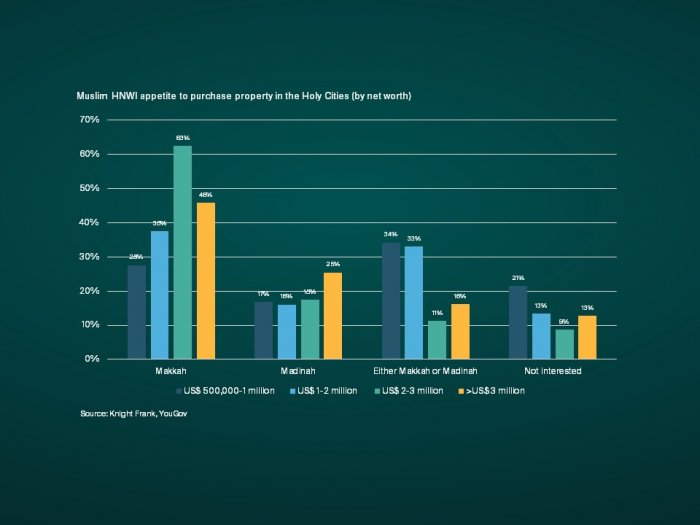

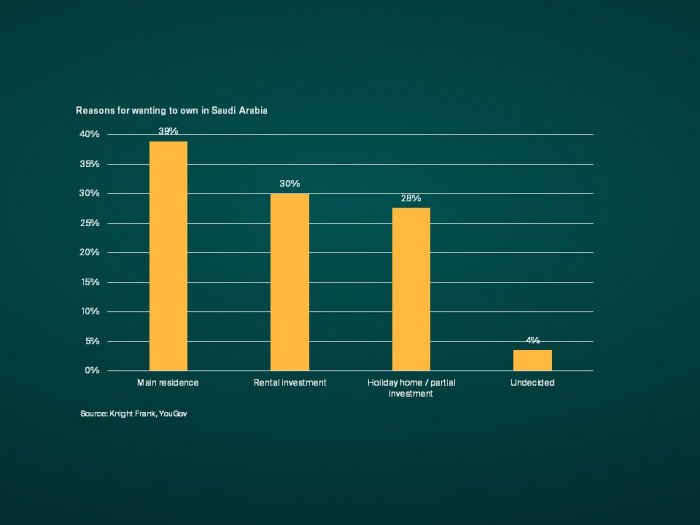

Faisal Durrani, Partner – Head of Research, MENA, said: “1.8 million pilgrims performed Hajj during 2023. For many this is a life-long ambition, which is intrinsically attached to a desire to visit and/or live in Saudi Arabia. The fact that 84% of global HNWI interested in purchasing in Saudi would like to do so in one of the Holy Cities underscores the depth of pent-up demand for home ownership from outside the country. And the demand appears to be genuine, with 48% of those looking to purchase a property in Makkah intending to use it as a main residence”.

Harmen de Jong, Regional Partner – Head of Consulting, MENA added: “The new Premium Visa for property owners is a welcome move by the authorities. It is likely to bolster demand at a time when affordability and shifting residential market demand dynamics, largely driven by a greater desire among young intra-Saudi migrants to rent rather than own, has been slowing the level of deal activity. Indeed, nation-wide residential sales volumes were down 16% last year”.

Knight Frank says the total number of year-on-year real estate transaction volumes across all asset classes in Saudi Arabia slipped by 17% during 2023, while the total value of all deals declined by 9%.

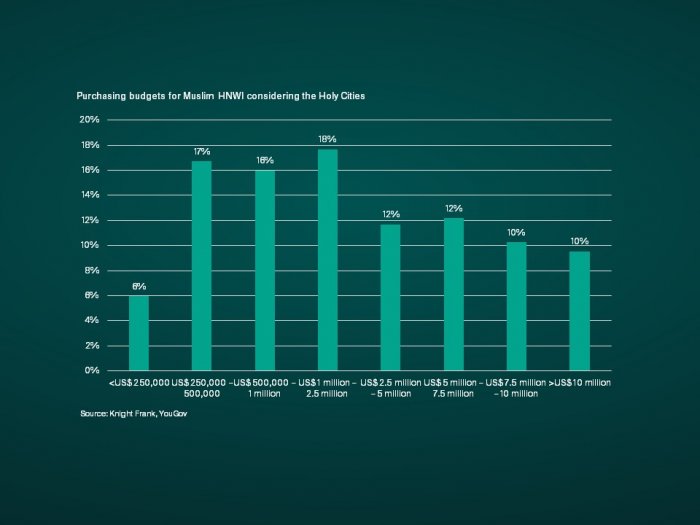

Muslim global HNWI budgets average US$ 4.7 million for the Holy Cities, according to Knight Frank. 40% of those considering Makkah are prepared to spend upward of US$ 5 million.

Durrani explained: “The US$ 4.7 million average Muslim global HNWI budgets for homes in the Holy Cities will undoubtedly give further impetus to the Giga project developers, many of whom we expect will begin marketing homes from upwards of US$ 1 million, which sits above the bulk of domestic Saudi budgets – two-thirds of Saudi’s have a home purchase budget of up to SAR 1.5 million”.

82% of international HNWI buyers are keen to own real estate in Saudi Arabia. Demand drivers underpinning the desire for home in the Kingdom stem largely from viewing Saudi as a ‘good investment opportunity’ (60%), with ‘cultural and religious reasons’ ranking as the second most important consideration (45%).

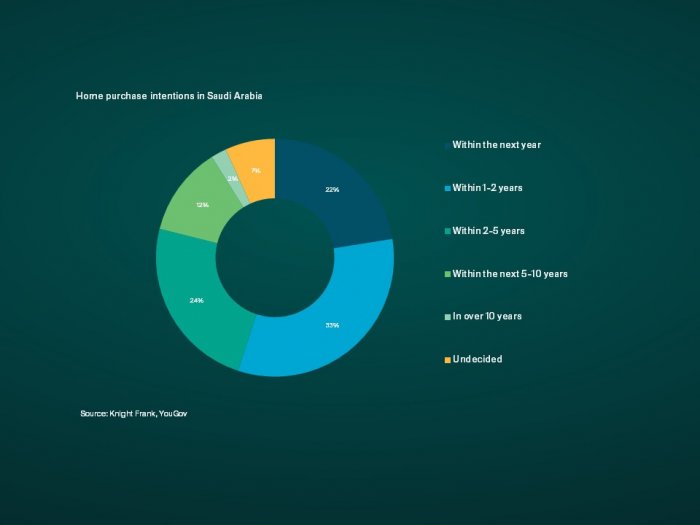

Speed also appears to be of the essence, with 22% of HNWI keen to complete a purchase this year, with a further 33% wanting to own property in the Kingdom in the next 12-24 months.

Cash transactions

The majority of those wanting to purchase a property in Makkah prefer to pay the full amount (66%) at the point of transaction, with only 33% stating they would like to follow a payment plan. Similarly, for those considering Madinah, 54% are keen to pay for the property in full at the time of purchase, with the rest seeking a payment plan, according to Knight Frank’s analysis.

The desire to purchase the property entirely using cash rises exponentially with personal levels of wealth, rising from 31% for those with a net worth of under US$ 500,000 to 78% for those worth more than US$ 3 million.

Mohamad Itani, Partner – Head of Residential Project Sales & Marketing, Saudi Arabia, said: “While the global wealthy clearly have a strong appetite to invest in the Kingdom, the challenge for developers will be to balance the expectations of the global wealthy with domestic buyers. For instance, 77% of those wanting to buy a property in Makkah are interested in apartments, while the desire for apartment living in Madinah is even higher at 84%. This is in sharp contrast to Saudi nationals, less than half of whom are interested in owning an apartment”.

High expectations

Knight Frank’s research reveals that 23% of Muslim global HNWI wanting to purchase in Makkah expect to be within walking distance to the Haram, and 63% expect direct views and to be within earshot of the Haram prayers.

Those interested in making a purchase in Madinah are slightly more relaxed in their expectations. While 40% expect to have some degree of access to the Haram (either walking or through public transportation), only 25% expect to be within walking distance, and under half (46%) expect direct views and to be able to hear the Haram prayers.

Investors for the Holy cities also have high capital value growth expectations, with 37% expecting annual price growth of 6-10% in Madinah, while separately nearly a third (31%) are expecting the same rate of increases in Makkah. Prices in Makkah have risen by an average of 5.5% over the last 3 years, compared to 5% in Madinah over the same period. This may prove to be a short-term challenge for developers as price growth across the country in this current cycle starts to peak. The other significant factor, according to Knight Frank, is off-plan versus ready property, with just 30% of global HNWI interested in the off-plan sales market in the Kingdom. 63% favour something completed.

-ENDS-